Millions Stolen: How Criminals Exploit UK’s Probate System Through Fake Wills

The Silent Theft: How Fake Wills Rob the Bereaved

A disturbing trend has emerged within the UK’s probate system, where a sophisticated criminal network is allegedly exploiting loopholes to defraud grieving families and steal millions from the estates of the deceased. BBC News investigations have uncovered a pattern of will fraud that leaves legal heirs disinherited and vulnerable to vast financial losses, often with little recourse for justice.

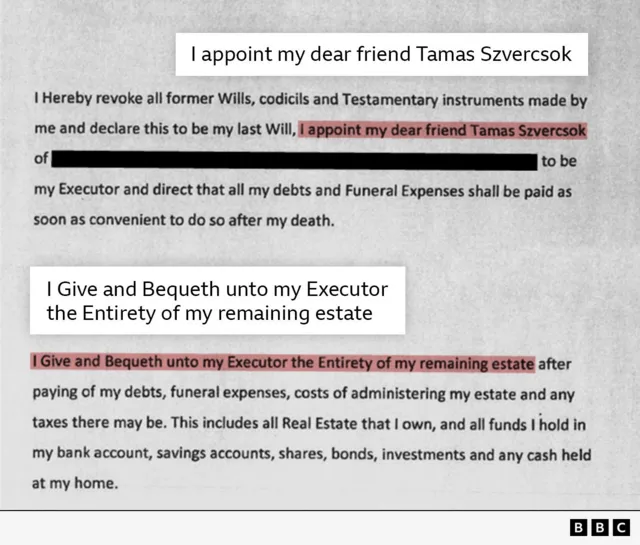

The modus operandi often begins when families, like sisters Lisa and Nicole, are informed of an inheritance from a deceased relative. In their case, their Aunt Christine, who had no known will, was reportedly set to leave them a substantial estate, including a valuable property. However, their inheritance was abruptly halted when a man, Tamas Szvercsok, presented a will naming him the sole beneficiary and executor, claiming to be Christine’s “dear friend.”

Despite the suspicious circumstances – including a misspelling of Christine’s address on the will and an address for Szvercsok that wouldn’t be built for another five years – authorities initially deferred to the presented will. The sisters’ attempts to involve the police and the probate service were met with the suggestion of costly civil action, a financial hurdle they could not overcome, leaving them in a state of distress and disbelief.

Exploiting the System: Bona Vacantia and Online Probate

The fraudsters are allegedly leveraging the UK’s “Bona Vacantia” – the official register of unclaimed estates. Legitimate heir-finder companies utilize this public database to locate rightful heirs. However, criminals appear to be using it as a starting point to fabricate wills and claim entire estates. The process was further simplified, and potentially compromised, when the application for probate became available online in 2017. This digital shift, while intended to streamline processes, has inadvertently created vulnerabilities. Applicants now need only declare on an online form that no inheritance tax is due, a system heavily reliant on trust and susceptible to abuse.

This system allows for the possibility of under-valuing estates to avoid the 40% inheritance tax threshold, which typically applies to assets exceeding £325,000. A concerning case illustrating this involves Charles Haxton, whose estate, including two properties potentially worth £2 million, was listed at just over £320,000. The will, presented by Roland Silye, bizarrely included a property in Hertfordshire that Mr. Haxton had no connection with, raising significant red flags.

A Network of Deception

Further investigation by financial fraud expert Graham Barrow revealed a potential connection between Tamas Szvercsok and Roland Silye. Both individuals share Hungarian origins and appear to be directors in a complex network of companies, some of which have been dissolved for using fraudulent addresses or have faced warnings for failing to provide accounts. This intricate web of businesses, often with overlapping addresses and similar names, is a hallmark of organized criminal activity, allowing for the dispersal of funds and making law enforcement efforts more challenging.

The criminal enterprise appears to extend further, with Bela Kovacs also linked to this network and named as the beneficiary in the will of Michael Judd. Neighbours of Mr. Judd reported his intention to find an older will, making the emergence of a new one, naming an unknown beneficiary, highly suspicious. Mr. Kovacs refused to comment when approached by the BBC.

Forensic Clues and Troubling Patterns

Handwriting analysis by expert Christina Strang suggests that a single individual may be responsible for forging not only the wills themselves but also the signatures of witnesses. These witnesses, often unknown to the deceased and sometimes fictitious, add another layer of deception. The investigation also uncovered disturbing similarities in how the properties of the deceased were treated: ransacking, hasty clearing of belongings that could be valuable heirlooms, and houses being subsequently used for illicit activities like cannabis cultivation.

These patterns strongly indicate a coordinated effort to quickly liquidate assets and disappear, often leaving a trail of unanswered questions and financial ruin for the rightful heirs. The scale of the operation is immense, with multiple companies, linked individuals, and suspiciously similar will formats pointing towards a well-organized criminal ring.

Systemic Failures and a Call for Reform

The BBC’s investigation has prompted action, with bank accounts linked to dozens of suspected fraudulent companies being suspended. HM Revenue & Customs (HMRC) is also investigating Roland Silye for potential inheritance tax evasion related to Charles Haxton’s estate, and has suspended the sale of Michael Judd’s property due to similar concerns. Meanwhile, disputes like the one over Christine Harverson’s estate remain frozen, leaving families in limbo.

Former MP Sir Bob Neill, who chaired the House of Commons Justice Select Committee, has criticized the probate system’s move towards digitization, describing it as a “cheap fix” that lacks the sophisticated fraud detection capabilities of other sectors, like insurance. He argues that the previous system, which required in-person oaths at regional probate registries, provided a crucial layer of human oversight and scrutiny that is now lost. This lack of personal interaction and rigorous checks has created an environment ripe for exploitation, leaving the system vulnerable to large-scale fraud that is difficult to track and prosecute.

The Ministry of Justice acknowledges the issue, stating it is collaborating with law enforcement to combat such criminal activities. However, the persistent exploitation of the system suggests a critical need for reform to better protect the vulnerable and ensure that the estates of the deceased are distributed according to their true wishes, not the predatory schemes of criminals.

Post Comment